Kerala State Government Employees News

Wednesday, October 20, 2010

Friday, October 15, 2010

DAM sure the DA will cross 7% + in January 2011:C.J.Mathews Sankarathil MBA

Expressindia » Story

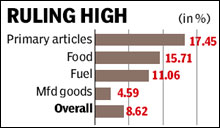

Costly food pushes inflation to 8.62%

| Font Size |

New Delhi Annual inflation as measured by wholesale price index (WPI) rose slightly to 8.62% in September, strengthening the case for the Reserve Bank of India (RBI) to hike key interest rates once again at its monetary policy review on November 2. The main reason behind the rise was the acceleration of food inflation to 15.71% from the previous month’s 14.64%, making analysts wonder if stubborn food inflation has become a structural cause for high headline inflation.

Since March, RBI has lifted the repo rate (the rate at which the central bank lends money to commercial banks), five times by a total of 125 basis points to 6%.However, RBI governor D Subbarao said in Chandigarh that the central bank would study inflation data before deciding on further policy action.

“We will study the de-segregated inflation data in the monetary policy review next month. Inflation figure would be one of the variables to be looked at during the review. I cannot speculate the stance of monetary policy,” Subbarao said. The RBI will also have to factor in the information that industrial output growth fell nearly by half to 5.57% in August this year from a year ago, in contrast with the revised figure of 15.2% for July, and bearing out the erratic nature of output growth in recent months. The RBI said last month that it was nearing completion of the process of “normalising” policy rates.

In a recent interview with FE, Prime Minister’s economic advisory council chairman C Rangarajan had said that until inflation comes down to 6-6.5%, the RBI would need to continue taking action.

“Our expectation is that inflation rate would come down to 6.5% only by December. Inflation at 7-8% level would, in my view, warrant one more dose of monetary policy action,” Rangarajan said.

“Our expectation is that inflation rate would come down to 6.5% only by December. Inflation at 7-8% level would, in my view, warrant one more dose of monetary policy action,” Rangarajan said. The 10-year bond yield edged 1 basis point higher to 8.05% after the data. It had closed at 8.02% in the previous session.

Finance Minister Pranab Mukherjee has expressed concern over the rising prices, saying that managing inflation has been one of his biggest challenges. “One of my biggest challenges is to control inflation; but at the same time, I should not stand in the way of higher growth trajectory,” Mukherjee said in Kolkata.

Meanwhile, chief economic advisor Kaushik Basu exuded confidence that inflation will moderate to 6% by March-end. “Inflation is virtually holding constant between 8.5% and 8.6%... For the first time, both core CPI and the WPI are in single digit...(We are) hopeful of year-end estimate holding at 6%,” he said.

“I expect RBI to continue its calibrated tightening – 25 basis points hike in both repo and reverve repo rates and may be also 25 basis points increase in banks\' cash reserve ratio.” said Rupa Rege Nitsure, chief economist, Bank of Baroda.

Prices of primary articles – food, non-food articles and minerals – shot up 17.45% on an annual basis according to wholesale price index data released by the government on Friday. Prices of fuel and power went up 11.06%, while manufactured goods became expensive by 4.59% during the month.

This is the second consecutive month in which inflation has stayed in single digit, after the base year for comparing price rise was changed from 1999-2000 to 2004-2005. Prior to the base year change, the inflation figure was over 10% until July.

Inflation was 8.51% in August. The July figure, meanwhile, has been revised upwards to 10.31% from the provisional estimate of 9.97%.

It is my promise to Get 7% + D.A for Jan 2011 :- C.J.Mathews Sankarathil,MBA

C. J.MATHEWS SANKARATHIL MBA

Rising prices of food and manufactured products will continue pushing up overall inflation untill November when the kharif crop hits the markets.

According to a median forecast of 11 economists polled by DNA, inflation in September is expected to come around 8.55%.

The government is expected to announce the September data on Thursday.

India’s inflation indicator - the wholesale price index (WPI), is expected to remain sticky at August levels for September as well as October months.

“Food inflation will moderate from November. By then, the kharif harvest would have come in and food prices will tend to ease,” said Madan Sabnavis, chief economist, Care Rating.

In August 2010, WPI came in at 8.5% with food inflation at 14.64%, manufactured products at 4.78% and fuel & power at 12.55% higher compared with same period last year.

It should also be noted that the index for the month of August was based on the revised WPI format with a new base year i.e. 2004-05 and 241 new items. Inflation according to the old index was 9.5%.

The latest data on food inflation shows that it was at 16.24% as on September 25, 2010 as compared with a year ago. Fuels and power had increased by 10.73% during the same period.

Economists expect that food prices and manufactured products prices have been high in September and will continue to stay high in October too.

However, by March 2011, economists still expect that overall inflation will cool down. “We expect it will come down to 5.5% by March 2011,” said A Prasanna, vice-president, ICICI Securities Primary Dealership.

Reserve Bank of India (RBI) has been closely monitoring rising prices through WPI and other indicators like the Consumer Price Index (CPI) too. “CPI will continue to remain high. Only the high base will tend to moderate it a bit. But prices will continue to be high,” said Sabnavis.

If inflation stays high, speculations of further rate hikes by RBI will also gain ground since RBI has been resorting to rate hikes citing inflationary pressures in the past.

“We expect a 25 basis points hike in policy rates in the next review,” said Dharmakirti Joshi, chief economist of Crisil, the rating agency.

RBI will review its credit and monetary policy on November 2, 2010.

It is my promise to Get 7% + D.A for Jan 2011 :- C.J.Mathews Sankarathil,MBA

C.J.MATHEWS SANKARATHIL MBA

Inflation again flies only..........................................................!

The annual inflation rate of India's prices of food, as measured by the wholesale price index, or WPI, for the week ended October 2 marginally rose to 16.37 per cent from the 16.24 per cent of the preceding week, due to higher prices of milk, vegetables, fruits and wheat.

The rate of inflation for the corresponding week in the preceding year was 11.21 per cent. The 52-week average inflation for the week ended October 2 was 18.62 per cent, as per the data released by the Ministry of Commerce and Industry.

The annual rate of inflation under the "Non-Food Articles" category rose to 22.73 per cent from the 22.15 per cent of the preceding week. The 52-week average inflation for the week ended October 2 was 13.81 per cent.

Primary articles

The annual rate of inflation for the week ended October 2 was 18.54 per cent, slightly lower than the 18.53 per cent of the preceding week. It was 8.78 per cent for the corresponding week of the preceding year. The 52-week average inflation for the week was 18.44 per cent, say the data.

The index for this group, with a weightage of 22.02 per cent, increased by 0.66 per cent over the preceding week.

These groups and items showed variations:

The index for the "Food Articles" category increased by 0.89 per cent from the preceding week, due to the higher prices of fruits and vegetables, gram, bajra, masur, urad, barley and moong. However, those of fish-marine, arhar and condiments and spices declined.

Friday, October 8, 2010

Retirement Age of Central Govt employees will remain 60, but why 55 and a unification only for Kerala Government Employees? Protest- C.J.Mathews Sankarathil, MBA

No raise in retirement age of Central govt employees: Cabinet Secretary.

Putting an end to speculation that the retirement age of Central government employees will be raised, the Centre has made it clear that it has no plans to raise the age for superannuation.

"No, there is no such plan. There is no thinking at all. The status quo will continue," Cabinet Secretary K M Chandrasekhar said when asked whether there is any move in this regard.

Currently, the retirement age of Central government employees is 60 years.

Chandrasekhar said there have been rumours that it would be raised but it was nothing but a "wishful thinking".

"I tried to find out. But there is no file in (Department of) Expenditure, no file in DoPT (Department of Personnel and Training). There is nothing. It is more of a wishful thinking," he said in an interview.

The Cabinet Secretary also said the government has no plans to bring an uniformity in the retirement age among the state government employees.

"The states will decide their own retirement age," he said.

All states have their own retirement age -- starting from 55 years (Kerala) to 60 years (Uttar Pradesh, Assam etc). The Madhya Pradesh government teachers retire at the age of 62 years.

Source : Zee News.

"No, there is no such plan. There is no thinking at all. The status quo will continue," Cabinet Secretary K M Chandrasekhar said when asked whether there is any move in this regard.

Currently, the retirement age of Central government employees is 60 years.

Chandrasekhar said there have been rumours that it would be raised but it was nothing but a "wishful thinking".

"I tried to find out. But there is no file in (Department of) Expenditure, no file in DoPT (Department of Personnel and Training). There is nothing. It is more of a wishful thinking," he said in an interview.

The Cabinet Secretary also said the government has no plans to bring an uniformity in the retirement age among the state government employees.

"The states will decide their own retirement age," he said.

All states have their own retirement age -- starting from 55 years (Kerala) to 60 years (Uttar Pradesh, Assam etc). The Madhya Pradesh government teachers retire at the age of 62 years.

Source : Zee News.

Food price Index flying ! Chance leads to 7% D.A in Jan 2011: C.J.Mathews Sankarathil,MBA

- * Food price index up 16.44 pct vs 15.46 week ago

* Fuel price index up 10.73 pct vs 11.48 week ago

* Aug consumer price index up 9.88 pct vs 11.25 pct in July

* Cbank seen lifting key rate by 25 bps by end-December (Adds fiscal deficit, CPI, analyst quote)

By Matthias Williams

NEW DELHI, Sept 30 (Reuters) - India's annual food price inflation continued to quicken in mid-September as heavy rains disrupted supplies and analysts see another rate hike by the year end as the central bank acts to stamp down high inflation.

The Reserve Bank of India (RBI) has said emerging macroeconomic conditions, especially prices, would determine its future action, with five rate hikes since mid-March having brought monetary conditions close to normal.

The surge is also a political concern for the ruling Congress party, which faces key state elections this year and next. With a third of the world's poor living in India, the country had seen governments being voted out over high food prices.

Food makes up around 14 percent of the wholesale price index (WPI), the most watched price gauge in India. Policymakers had expected the good summer harvest to slow price rises.

The RBI projects headline inflation INWPI=ECI to ease to 6 percent by March, when the current financial year ends, from 8.5 percent in August, but noted in its September policy review that food prices continued to contribute to inflationary pressures.

"We don't expect food inflation to ease substantially before the kharif (winter harvested) crop comes into the market," said Indranil Pan, chief economist at Kotak Mahindra Bank.

The central bank last raised its repo rate, at which it lends to banks, on Sept. 16 by 25 basis points to 6 percent. Analysts expect another quarter-point rise by the year end.

Data on Thursday showed the food price index in the year to Sept. 18 rose 16.44 percent, compared with 15.46 percent in the previous week, on higher prices of pulses, onions and vegetables.

It was the second straight rise under a new data series -- with a different base year of 2004-05, new components and weightings -- under which readings began in the week to Sept. 4.

Separate data showed the consumer price index (CPI) for industrial workers rose 9.88 percent in August, slower than July's 11.25 percent increase. The CPI component basket has a higher proportion of food items than the WPI basket

Subscribe to:

Posts (Atom)